Natalie is a business writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on July 7, 2022

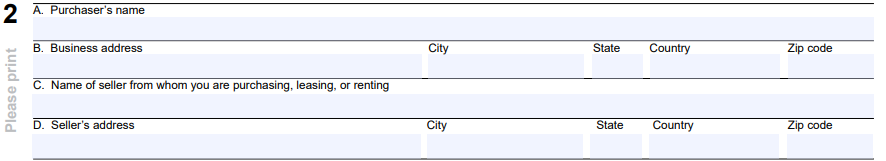

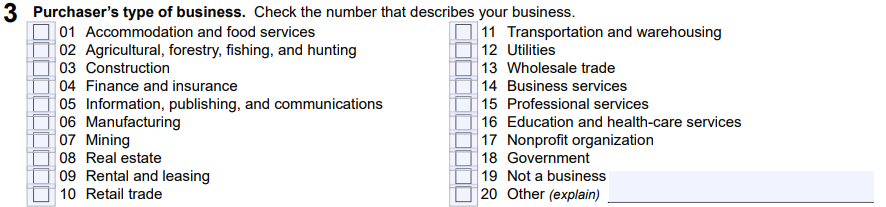

If you have recently launched or are planning to launch a business that will sell products or services in North Carolina, you may want to get a certificate of exemption, or several of them, before you start doing business, as this can save you a lot of time and money.

This document is known as a resale certificate in most other states, and attaining one’s a relatively simple process, as detailed in this step-by-step guide.

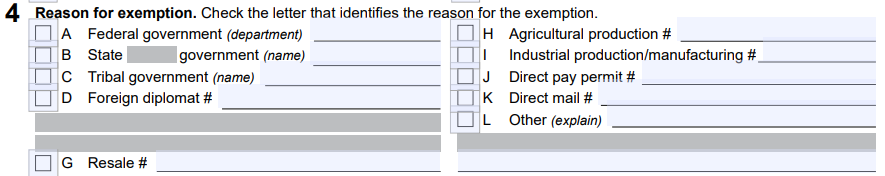

If your business has a valid certificate of exemption, you can buy goods from a wholesaler without paying North Carolina sales tax, though you may pay a use tax. Depending on the size of your business, this can save you tens of thousands of dollars each year.

The catch is that whenever you do use a certificate of exemption to purchase goods, you are legally bound to resell those items and collect sales tax when you do so. If you do not resell those items, or fail to collect sales tax, the punishment could be costly fines or potential jail time.

Keep in mind, each certificate of exemption, also known as a resale license, applies to a single vendor. This means you’ll need a certificate of exemption for each one of your vendors.

You cannot use a certificate of exemption to buy items you do not intend to resell, such as a new computer for your business. This would be tax fraud, a felony offense. You are only able to buy items tax-exempt if you are going to collect sales tax on them later.

Not all wholesalers will accept certificates of exemption, nor do they have to. They may choose not to because of the risk of expired or false certificates, which would put the wholesaler on the hook for the sales tax.

In North Carolina, you’ll obtain the certificate of exemption form from the Department of Revenue. Keep in mind that you do not need to file the certificate with the state, but merely keep it in your records.

In a few states, a seller’s permit, or sales tax permit, also serves as a certificate of exemption that applies to all vendors. But in most states, including North Carolina, you’ll need a seller’s permit as well as certificates of exemption for each of your vendors.

The seller’s permit identifies you with your state as a collector of sales tax. If you sell tangible personal property or goods you are required to have a sales tax permit. In some states, even a service provider like a lawyer is required to have a sales tax permit and collect state sales tax.

The resale certificate applies to items that you buy for resale, or for parts that you buy to manufacture something for sale.

In North Carolina, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

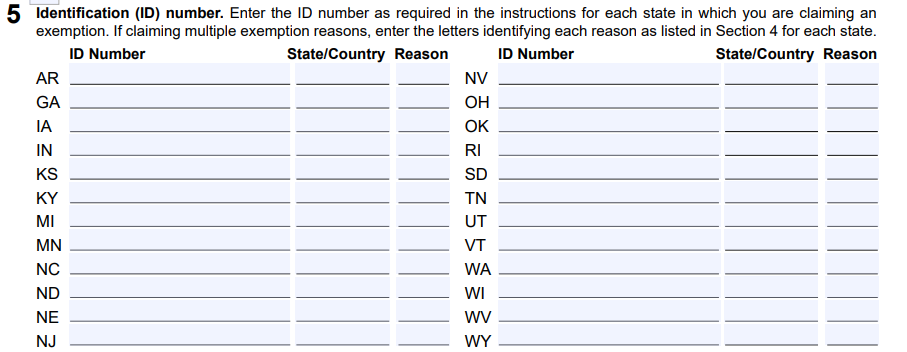

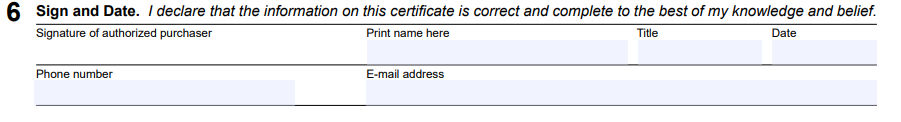

NOTE: North Carolina is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

![]()

For assistance, contact the North Carolina Department of Revenue at 1-877-252-3052.

In North Carolina, certificates of exemption do not expire as long as the certificate is a blanket exemption and at least one purchase is made within 12 months.

Certificates of exemption can be a bit of a hassle, but in North Carolina they are an absolute necessity. So take the time to get certificates for each of your vendors to ensure full compliance with your state’s tax regulations.